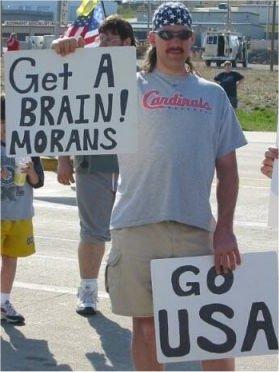

"Oh God!.... I really should.... argh! pay attention next election..."

"Oh God!.... I really should.... argh! pay attention next election..."

Petrol hikes tougher than rate rises, says Wizard

September 5, 2005 - 4:34PM

The rising cost of petrol is having a bigger impact on household finances than movements in official interest rates, a financial expert says.

A survey commissioned by mortgage financiers Wizard Home Loans showed 82 per cent of Australian home owners said rising fuel costs had hurt their hip pockets more than higher mortgage payments triggered by the interest rate rise in March, Wizard chairman Mark Bouris said.

The survey comes as the Reserve Bank prepares to meet again to consider monetary policy, although most analysts predict the rate will not change from 5.50 per cent.

The March interest rate rise of .25 per cent increased the average monthly mortgage payment by $33 a month or $396 a year, he said.

"Mortgage repayments used to be the major concern for Australian homeowners," Mr Bouris said.

"Now, rising fuel costs hold the title with a massive majority.

"What's more, while half of Australian homeowners think an interest rate cut is not on the cards, meaning no reduction in their mortgage repayments, they still say higher fuel costs will continue to be the biggest drag on family finances."

AAPSo what to do about high oil prices? Let's consult the brains trust.

Oil producers must boost petrol production: Costello

September 5, 2005 - 4:16PM

There was little the government could do to cut soaring petrol prices except pressure oil exporting nations to boost production, Treasurer Peter Costello said today.

Mr Costello, speaking in Jakarta where he was due to meet Indonesian government officials later today, said he would be pushing nations such as Indonesia to boost production as one way of taking pressure off high prices.

He warned high prices were not only a risk to net oil importing nations such as Australia but to exporters themselves because of what might happen to the global economy.

Wait, so oil producers should do themselves out of incredible, and sustainable (medium term) profits, at a time when most of them are just recovering from record low oil prices of the 90s? Sure Peter, we've got the upper hand there. Take Saudi Arabia, please, practically the only thing keeping Al Qaida out of power is massive amounts of government spending, fuelled by increased oil revenue, the idea that the Saudis would make themselves vulnerable to militants, even if they had the extra infrastructure to physically get more oil out of and even if we had the increased refinery capacity to process it, is a laugh.

Mr Costello said he would raise with Indonesia, a member of OPEC, and at meeting of Asia

Pacific finance ministers later this week, the need to boost oil production globally.

"We would like to see those oil exporting countries that can do so lift production," he told reporters.

"We don't think it's in the interest of oil importers, and Australia is a net oil importer, the high prices.

"We don't think long term it's in the interests of the exporter themselves, because what they need is reliable customers to be assured of reliable prices.

Because otherwise we'll get our oil from somewhere else, like MARS!

"I don't think it's in the long term interests to have wild fluctuations in the the world oil price."

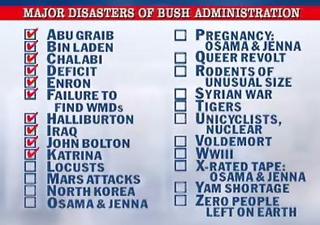

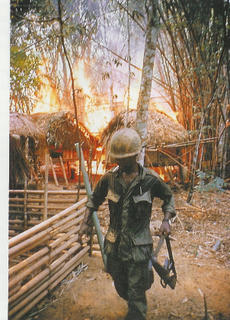

Gee Pete, should have thought about that before you turned off the world's fourth largest producer of the black stuff. What's that? You can't burn 'freedom'? That's too bad, now pay the man in the robes.

Mr Costello said high oil prices could affect nations such as China, upon which Australia's economy is increasingly dependant.

He said high oil prices could precipitate a recession, which would be good for no one.

"If the world went into recession then prices would come back down, but we do not want to go into reccssion," Mr Costello said.

AAPThanks for looking out for the economic security of the country Peter, really great job. So how about taking this opportunity to subsidise other energy sources, you know, ones we can control the price of, like you already do with coal? Hello? Peter?

I'll come back when you're done negotiating with OPEC.